EXHIBIT 99.2

Published on August 28, 2023

Exhibit 99.2

Investor Presentation Kimco Acquisition of RPT Realty August 28, 2023 Mary

Brickell Village Miami, FL

Safe Harbor Forward Looking Statements This communication contains certain

“forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Kimco intends such forward-looking statements

to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with the safe harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe Kimco’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “expect,” “intend,” “commit,” “anticipate,”

“estimate,” “project,” “will,” “target,” “plan”, “forecast” or similar expressions. Forward-looking statements regarding Kimco and RPT, include, but are not limited to, statements related to the anticipated acquisition of RPT and the

anticipated timing and benefits thereof and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently

involve significant risks and uncertainties. You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which, in some cases, are beyond Kimco’s and RPT’s control and could

materially affect actual results, performances or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to, risks and uncertainties associated with: Kimco’s and RPT’s

ability to complete the proposed transaction on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary RPT shareholder approval and satisfaction of other closing

conditions to consummate the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction; risks related

to diverting the attention of Kimco and RPT management from ongoing business operations; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown or inestimable liabilities; the risk

of shareholder litigation in connection with the proposed transaction, including resulting expense or delay; the ability to successfully integrate the operations of Kimco and RPT following the closing of the transaction and the risk that such

integration may be more difficult, time-consuming or costly than expected; risks related to future opportunities and plans for the combined company, including the uncertainty of expected future financial performance and results of the

combined company following completion of the proposed transaction; effects relating to the announcement of the proposed transaction or any further announcements or the consummation of the proposed transaction on the market price of Kimco’s

common stock or RPT’s common shares or on each company’s respective relationships with tenants, employees and third-parties; the ability to attract, retain and motivate key personnel; the possibility that, if Kimco does not achieve the

perceived benefits of the proposed transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of Kimco’s common stock could decline; general adverse economic and local real estate conditions; the

impact of competition; the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; the reduction in income in the event of multiple lease terminations by

tenants or a failure of multiple tenants to occupy their premises in a shopping center; the potential impact of e-commerce and other changes in consumer buying practices, and changing trends in the retail industry and perceptions by retailers

or shoppers, including safety and convenience; the availability of suitable acquisition, disposition, development and redevelopment opportunities, the costs associated with purchasing and maintaining assets and risks related to acquisitions

not performing in accordance with our expectations; the ability to raise capital by selling assets; disruptions and increases in operating costs due to inflation and supply chain issues; risks associated with the development of mixed-use

commercial properties, including risks associated with the development, and ownership of non-retail real estate; changes in governmental laws and regulations, including, but not limited to changes in data privacy, environmental (including

climate change), safety and health laws, and management’s ability to estimate the impact of such changes; valuation and risks related to joint venture and preferred equity investments and other investments; valuation of marketable securities

and other investments, including the shares of Albertsons Companies, Inc. common stock held by Kimco; impairment charges; criminal cybersecurity attacks disruption, data loss or other security incidents and breaches; impact of natural

disasters and weather and climate-related events; pandemics or other health crises, such as COVID-19; the ability to attract, retain and motivate key personnel; financing risks, such as the inability to obtain equity, debt or other sources of

financing or refinancing on favorable terms or at all; the level and volatility of interest rates and management’s ability to estimate the impact thereof; changes in the dividend policy for Kimco’s common and preferred stock and Kimco’s

ability to pay dividends at current levels; unanticipated changes in the intention or ability to prepay certain debt prior to maturity and/or hold certain securities until maturity; Kimco’s and RPT’s ability to continue to maintain their

respective status as a REIT for United States federal income tax purposes and potential risks and uncertainties in connection with their respective UPREIT structure; and the other risks and uncertainties affecting Kimco and RPT, including

those described from time to time under the caption “Risk Factors” and elsewhere in Kimco’s and RPT’s Securities and Exchange Commission (“SEC”) filings and reports, including Kimco’s Annual Report on Form 10-K for the year ended December 31,

2022, RPT’s Annual Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other risks and uncertainties of which Kimco or RPT are not currently aware may also affect each of the

companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the date hereof or as of

the dates indicated in the forward-looking statements, even if they are subsequently made available by Kimco or RPT on their respective websites or otherwise. Neither Kimco nor RPT undertakes any obligation to update or supplement any

forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made. Important Additional

Information and Where to Find It In connection with the proposed transaction, Kimco will file with the SEC a registration statement on Form S-4 to register the shares of Kimco common stock to be issued in connection with the proposed

transaction. The registration statement will include a proxy statement/prospectus which will be sent to the shareholders of RPT seeking their approval of their respective transaction-related proposals. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED

TRANSACTION, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KIMCO, RPT AND THE PROPOSED TRANSACTION. Investors and security holders may obtain copies of these documents free of charge through the website

maintained by the SEC at www.sec.gov or from Kimco at its website, kimcorealty.com, or from RPT at its website, rptrealty.com. Documents filed with the SEC by Kimco will be available free of charge by accessing Kimco’s website at

kimcorealty.com under the heading Investors or, alternatively, by directing a request to Kimco at IR@kimcorealty.com or 500 North Broadway Suite 201, Jericho, New York 11753, telephone: (866) 831-4297, and documents filed with the SEC by RPT

will be available free of charge by accessing RPT’s website at rptrealty.com under the heading Investors or, alternatively, by directing a request to RPT at invest@rptrealty.com or 19 West 44th Street, Suite 1002, New York, NY 10036,

telephone: (516) 869-9000. Participants in the Solicitation Kimco and RPT and certain of their respective directors, trustees and executive officers and other members of management and employees may be deemed to be participants in the

solicitation of proxies from the shareholders of RPT in respect of the proposed transaction under the rules of the SEC. Information about Kimco’s directors and executive officers is available in Kimco’s proxy statement dated March 15, 2023

for its 2023 Annual Meeting of Stockholders. Information about RPT’s trustees and executive officers is available in RPT’s proxy statement dated March 16, 2023 for its 2023 Annual Meeting of Shareholders. Other information regarding the

participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these

documents from Kimco or RPT using the sources indicated above. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act. 1 Investor Presentation | Kimco and RPT Realty

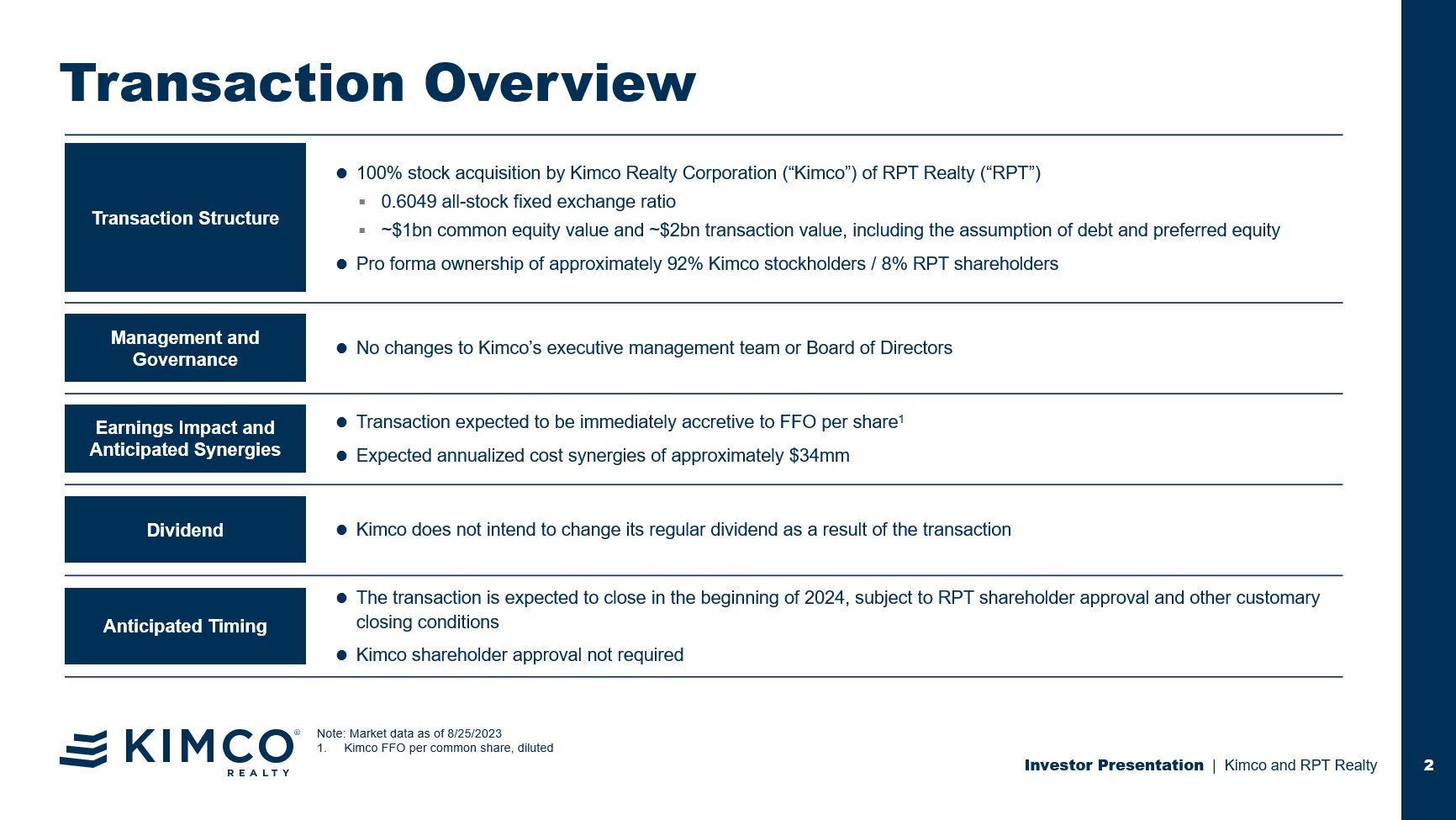

Transaction Overview 2 100% stock acquisition by Kimco Realty Corporation

(“Kimco”) of RPT Realty (“RPT”) 0.6049 all-stock fixed exchange ratio ~$1bn common equity value and ~$2bn transaction value, including the assumption of debt and preferred equity Pro forma ownership of approximately 92% Kimco stockholders

/ 8% RPT shareholders No changes to Kimco’s executive management team or Board of Directors Transaction expected to be immediately accretive to FFO per share1 Expected annualized cost synergies of approximately $34mm Kimco does not

intend to change its regular dividend as a result of the transaction The transaction is expected to close in the beginning of 2024, subject to RPT shareholder approval and other customary closing conditions Kimco shareholder approval not

required Investor Presentation | Kimco and RPT Realty Transaction Structure Management and Governance Earnings Impact and Anticipated Synergies Dividend Anticipated Timing Note: Market data as of 8/25/2023 Kimco FFO per common share,

diluted

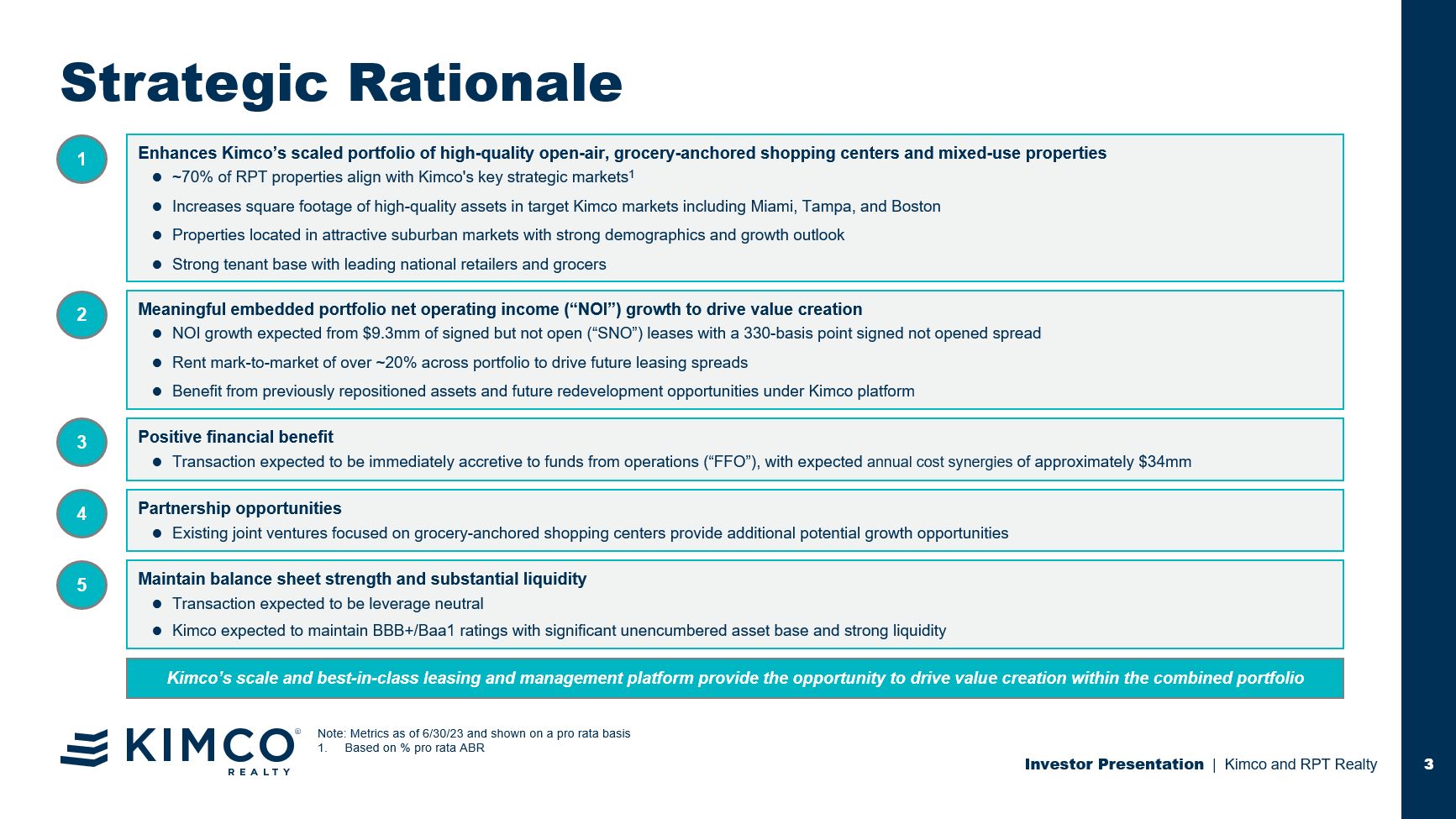

Strategic Rationale 3 Investor Presentation | Kimco and RPT

Realty 1 Enhances Kimco’s scaled portfolio of high-quality open-air, grocery-anchored shopping centers and mixed-use properties ~70% of RPT properties align with Kimco's key strategic markets1 Increases square footage of high-quality

assets in target Kimco markets including Miami, Tampa, and Boston Properties located in attractive suburban markets with strong demographics and growth outlook Strong tenant base with leading national retailers and grocers Meaningful

embedded portfolio net operating income (“NOI”) growth to drive value creation NOI growth expected from $9.3mm of signed but not open (“SNO”) leases with a 330-basis point signed not opened spread Rent mark-to-market of over ~20% across

portfolio to drive future leasing spreads Benefit from previously repositioned assets and future redevelopment opportunities under Kimco platform 2 Positive financial benefit Transaction expected to be immediately accretive to funds from

operations (“FFO”), with expected annual cost synergies of approximately $34mm 3 Partnership opportunities Existing joint ventures focused on grocery-anchored shopping centers provide additional potential growth opportunities 4 Maintain

balance sheet strength and substantial liquidity Transaction expected to be leverage neutral Kimco expected to maintain BBB+/Baa1 ratings with significant unencumbered asset base and strong liquidity 5 Note: Metrics as of 6/30/23 and

shown on a pro rata basis Based on % pro rata ABR Kimco’s scale and best-in-class leasing and management platform provide the opportunity to drive value creation within the combined portfolio

Providence Marketplace Nashville, TN Investor Presentation | Kimco and RPT

Realty 4 RPT Realty Portfolio Overview Properties | GLA1 56 | 13.3mm Same Property Leased Rate 94.9% 3-Mile Average HHI2 $122K ABR from Grocery Anchored Centers 72% Spread on Comparable New Leases for TTM 10.8% Signed Not

Opened Spread | Rent Mary Brickell Village Miami, FL The Crossroads Palm Beach, FL Note: Metrics as of 6/30/23 and shown on a pro rata basis Gross leasable area Household income Based on Same Property

pool 97.6% 88.3% (Total) (Anchor) (Small Shop) 330bps3 | $9.3mm Northborough Crossing Boston, MA

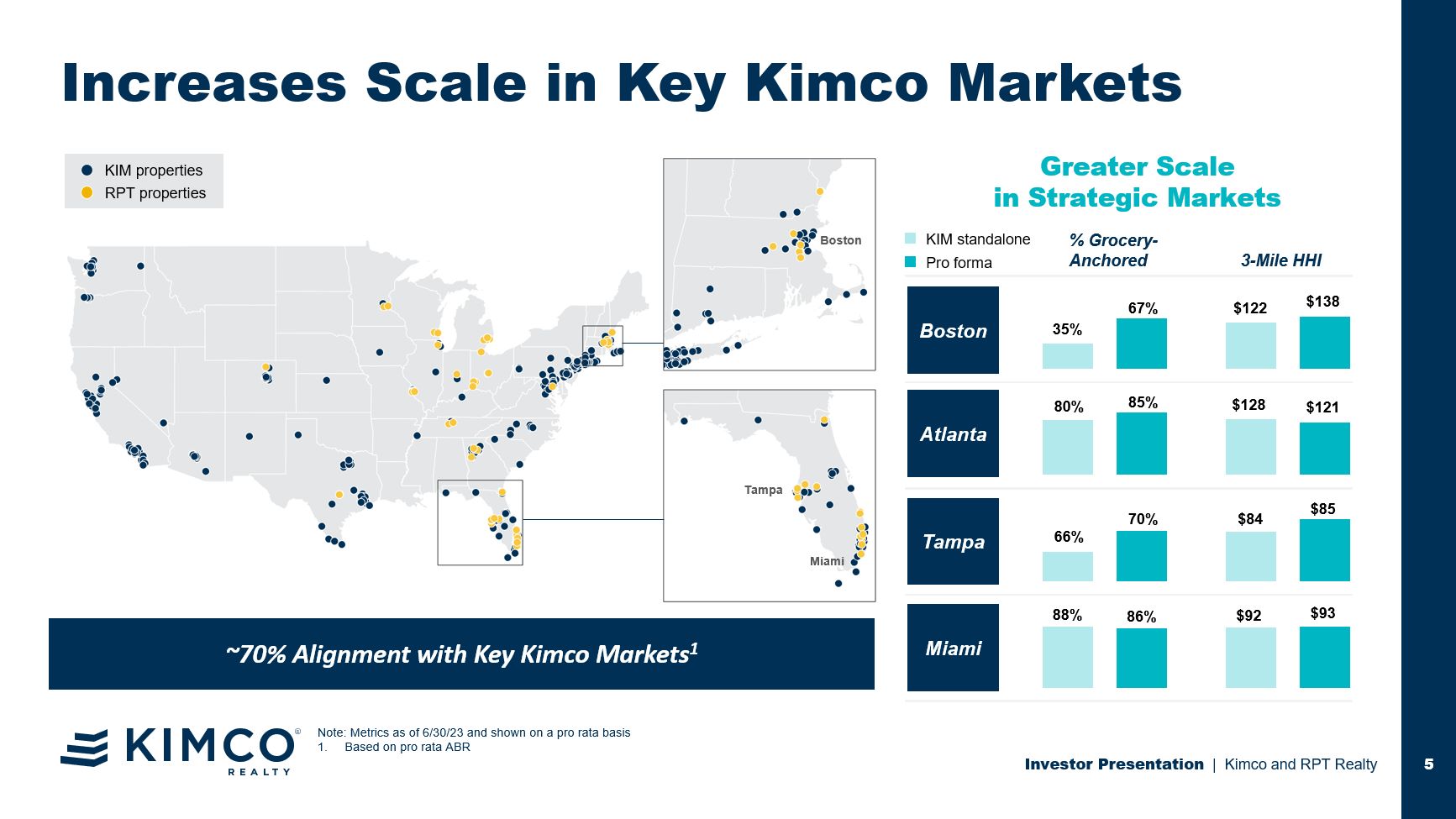

Increases Scale in Key Kimco Markets 5 Greater Scale in Strategic

Markets Investor Presentation | Kimco and RPT Realty ~70% Alignment with Key Kimco Markets1 Note: Metrics as of 6/30/23 and shown on a pro rata basis Based on pro rata ABR Boston Tampa KIM properties RPT properties Miami %

Grocery-Anchored 3-Mile HHI Miami Boston Tampa Atlanta KIM standalone Pro forma

Meaningful Embedded Growth Opportunity 6 Investor Presentation | Kimco and RPT

Realty Mary Brickell Village, Miami FL 199KGLA $82K3-Mile HHI 93.4%Leased 90%+MTM Located in densely populated Downtown Miami market, and is anchored by Publix (3-mile population of 232k) Select tenants: Publix, LA Fitness, MOXIE’S,

Shake Shack Future Kimco Signature Series® property Significant MTM realization from lease-up over next 2-3 years Attractive retail and mixed-use repositioning opportunities Marketplace of Delray, Miami FL 213KGLA $99K3-Mile

HHI 64.8%Leased 40%+MTM Attractive property located in Delray Beach is well located near major highways, I-95 and Turnpike Expressway Select tenants: Ross, Dollar Tree, Office Depot Near-term 2025 transformation underway, with high

interest from a large grocery anchor and a national home improvement retailer Village Shoppes at Canton, Boston MA 286KGLA $151K3-Mile HHI 84.2%Leased 14%+MTM Grocery-anchored shopping center located in high-income suburb of Boston,

MA Select tenants: Shaw’s, CVS, Marshalls, Five Guys, Chicos, Verizon, AT&T Attractive lease-up opportunity on vacant space (three spaces under LOI with small shop tenants at attractive rates) Note: Metrics as of 6/30/23 and shown on

a pro rata basis

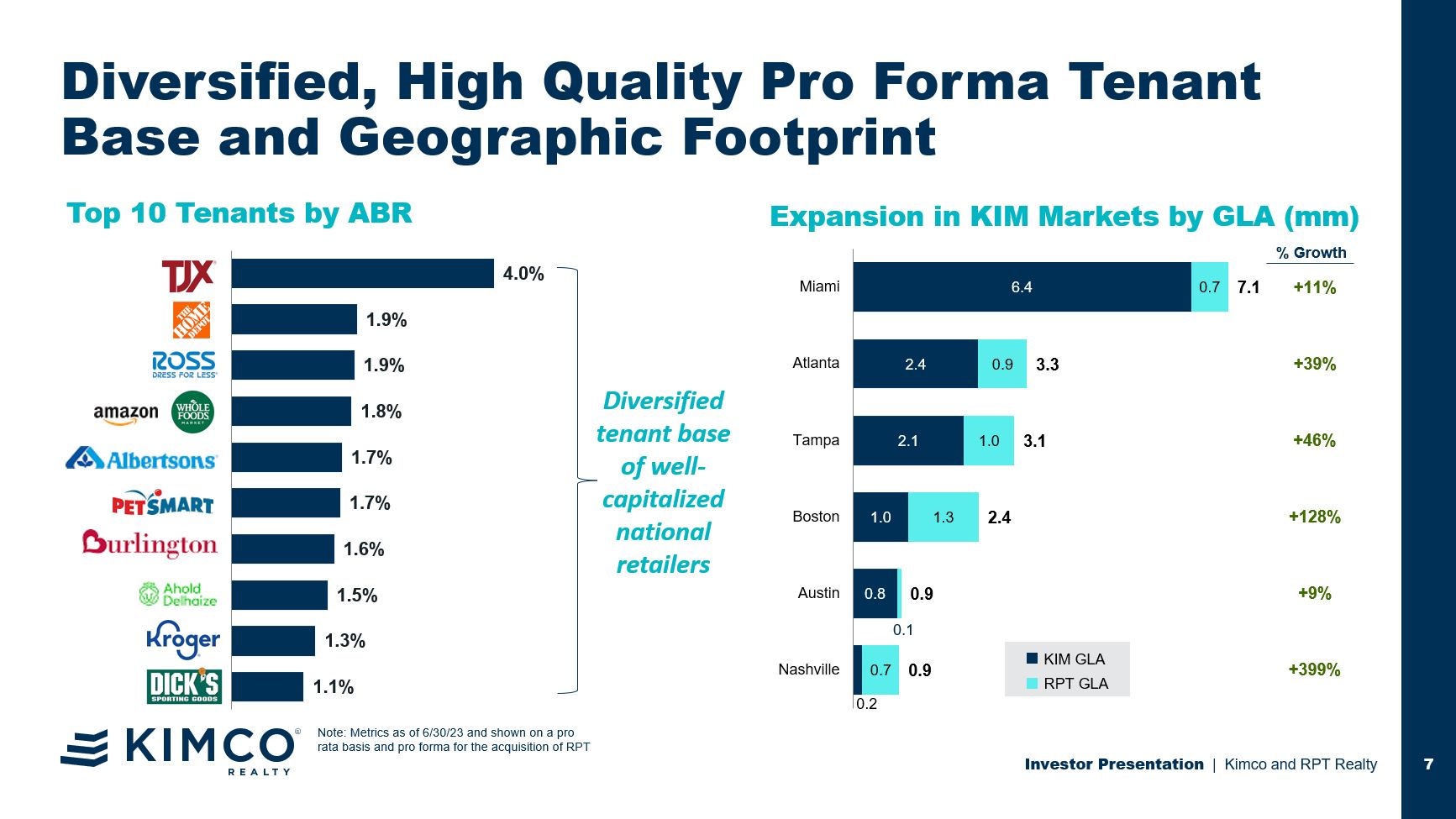

Diversified, High Quality Pro Forma Tenant Base and Geographic

Footprint 7 Investor Presentation | Kimco and RPT Realty Top 10 Tenants by ABR Expansion in KIM Markets by GLA (mm) Diversified tenant base of well-capitalized national retailers Note: Metrics as of 6/30/23 and shown on a pro rata basis

and pro forma for the acquisition of RPT +11% +39% +46% +128% +9% +399% % Growth KIM GLA RPT GLA

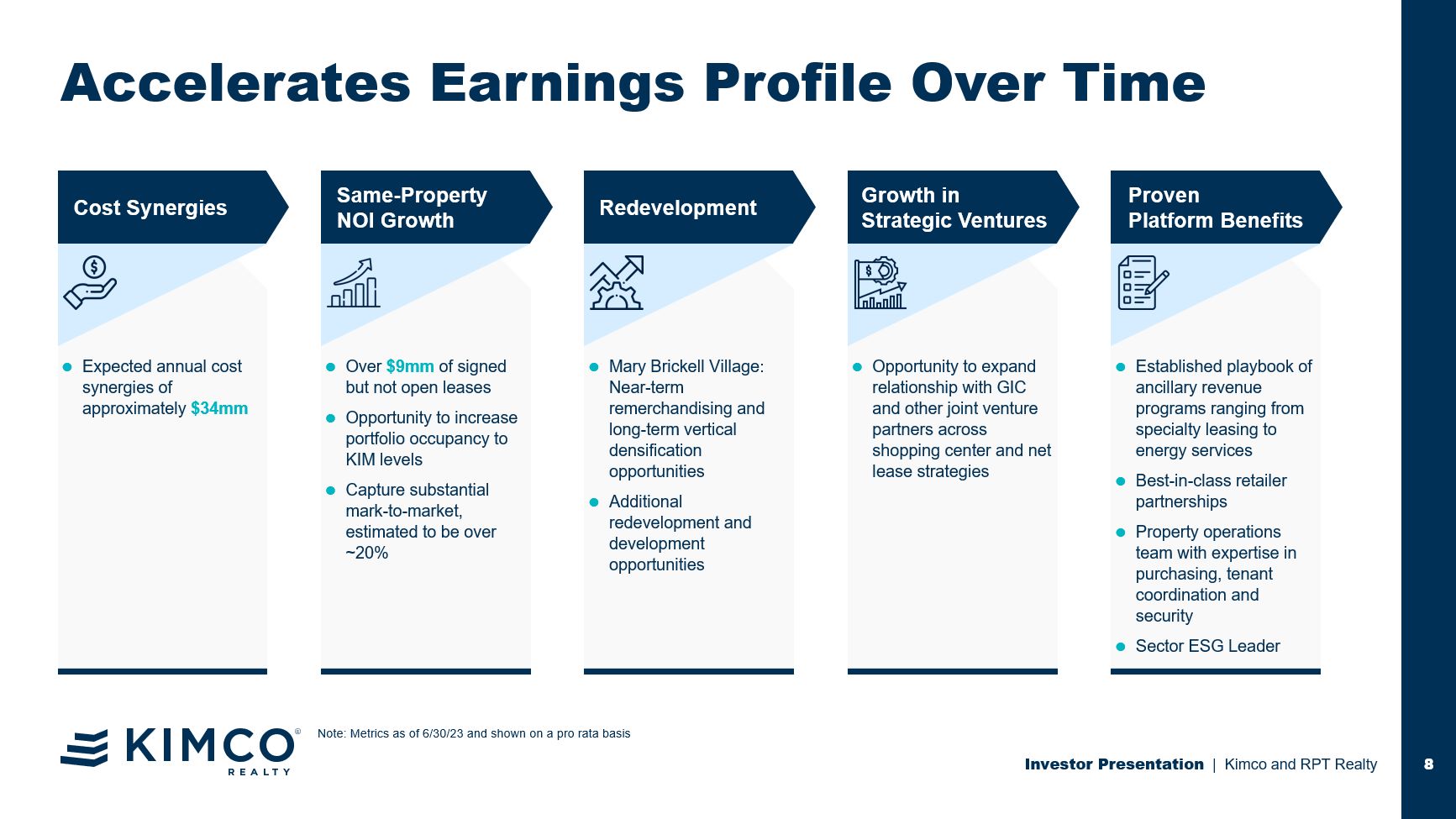

Accelerates Earnings Profile Over Time 8 Investor Presentation | Kimco and RPT

Realty Note: Metrics as of 6/30/23 and shown on a pro rata basis Cost Synergies Expected annual cost synergies of approximately $34mm Same-Property NOI Growth Over $9mm of signed but not open leases Opportunity to increase portfolio

occupancy to KIM levels Capture substantial mark-to-market, estimated to be over ~20% Redevelopment Mary Brickell Village: Near-term remerchandising and long-term vertical densification opportunities Additional redevelopment and

development opportunities Growth in Strategic Ventures Opportunity to expand relationship with GIC and other joint venture partners across shopping center and net lease strategies Proven Platform Benefits Established playbook of ancillary

revenue programs ranging from specialty leasing to energy services Best-in-class retailer partnerships Property operations team with expertise in purchasing, tenant coordination and security Sector ESG Leader

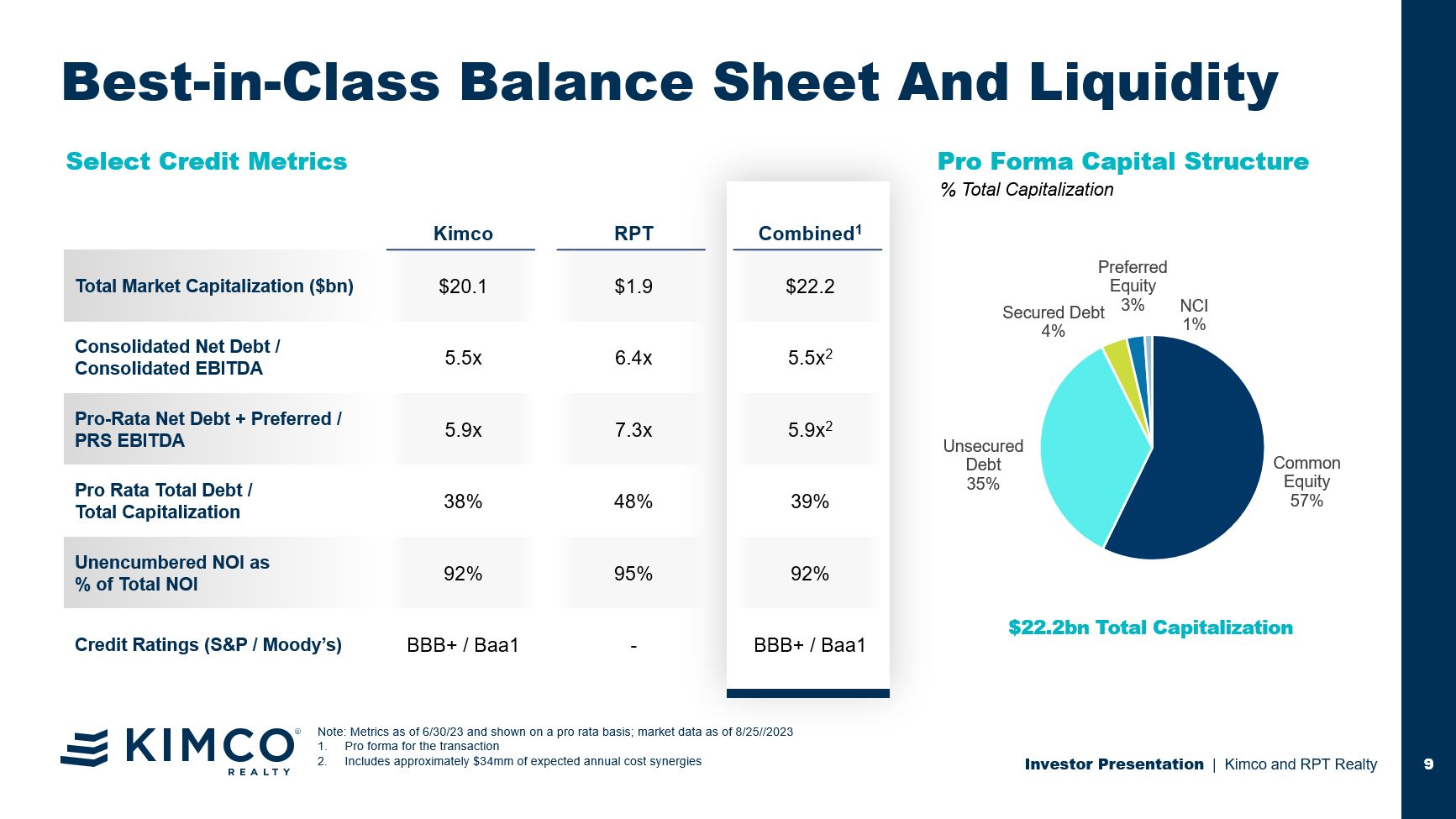

Kimco $20.1 5.5x 5.9x 38% 92% BBB+ /

Baa1 RPT $1.9 6.4x 7.3x 48% 95% - Combined1 $22.2 5.5x2 5.9x2 39% 92% BBB+ / Baa1 Best-in-Class Balance Sheet And Liquidity 9 Total Market Capitalization ($bn) Consolidated Net Debt / Consolidated EBITDA Pro-Rata Net Debt +

Preferred / PRS EBITDA Pro Rata Total Debt / Total Capitalization Unencumbered NOI as % of Total NOI Credit Ratings (S&P / Moody’s) Select Credit Metrics Pro Forma Capital Structure $22.2bn Total Capitalization % Total

Capitalization Investor Presentation | Kimco and RPT Realty Note: Metrics as of 6/30/23 and shown on a pro rata basis; market data as of 8/25//2023 Pro forma for the transaction Includes approximately $34mm of expected annual cost

synergies

Investor Presentation | Kimco and RPT Realty The Shops on Lane Avenue

Columbus, OH