10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on February 20, 2026

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number

Commission file number

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Kimco Realty Corporation

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

||

|

||

|

Kimco Realty OP, LLC

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

None |

N/A |

N/A |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Kimco Realty Corporation |

|

Kimco Realty OP, LLC |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Kimco Realty Corporation Yes ☐ |

|

Kimco Realty OP, LLC Yes ☐ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Kimco Realty Corporation |

|

Kimco Realty OP, LLC |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Kimco Realty Corporation |

|

Kimco Realty OP, LLC |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Kimco Realty Corporation:

☑ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

Emerging growth company |

|

|

|

Kimco Realty OP, LLC:

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

☑ |

|

Smaller reporting company |

Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Kimco Realty Corporation ☐ |

|

Kimco Realty OP, LLC ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Kimco Realty Corporation |

|

Kimco Realty OP, LLC |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Kimco Realty Corporation |

|

Kimco Realty OP, LLC |

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Kimco Realty Corporation ☐ |

|

Kimco Realty OP, LLC ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Kimco Realty Corporation Yes |

|

Kimco Realty OP, LLC Yes |

The aggregate market value of the voting and non-voting common equity held by non-affiliates of Kimco Realty Corporation was approximately $

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

As of February 10, 2026, Kimco Realty Corporation had

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference to the Kimco Realty Corporation's definitive proxy statement to be filed with respect to the Annual Meeting of Stockholders expected to be held on May 21, 2026.

Index to Exhibits begins on page 51.

KIMCO REALTY CORPORATION

KIMCO REALTY OP, LLC

ANNUAL REPORT ON FORM 10-K

FISCAL YEAR ENDED DECEMBER 31, 2025

EXPLANATORY NOTE

This report combines the Annual Reports on Form 10-K for the year ended December 31, 2025, of Kimco Realty Corporation (the "Parent Company") and Kimco Realty OP, LLC ("Kimco OP"). Unless stated otherwise or the context requires, references to "Kimco Realty Corporation" or the "Parent Company" mean Kimco Realty Corporation and its subsidiaries, and references to "Kimco Realty OP, LLC" or "Kimco OP" mean Kimco Realty OP, LLC and its subsidiaries. The terms the "Company", "we", "our" or "us" refer to the Parent Company and its business and operations conducted through its directly or indirectly owned subsidiaries, including Kimco OP; and in statements regarding qualification as a Real Estate Investment Trust ("REIT") for U.S. federal income tax purposes, such terms refer solely to the Parent Company. References to "shares" and "shareholders" refer to the shares and shareholders of the Parent Company and not the limited liability company interest of Kimco OP.

The Parent Company is a REIT and is the managing member of Kimco OP. As of December 31, 2025, the Parent Company owned 99.79% of the outstanding limited liability company interests (the "OP Units") in Kimco OP. Noncontrolling OP Unit interests are owned by third parties and certain officers and directors of the Company.

Substantially all of the Parent Company’s assets are held by, and substantially all of the Parent Company’s operations are conducted through, Kimco OP (either directly or through its subsidiaries), as the Parent Company’s operating company, and the Parent Company is the managing member of Kimco OP. Management operates the Parent Company and Kimco OP as one business. The management of the Parent Company consists of the same individuals as the management of Kimco OP. These individuals are officers of the Parent Company and employees of Kimco OP.

Stockholders' equity and Members’ capital are the primary areas of difference between the Consolidated Financial Statements of the Parent Company and those of Kimco OP. Kimco OP’s Members' capital currently includes OP Units owned by the Parent Company and noncontrolling OP Units owned by third parties and certain officers and directors of the Company. OP Units owned by outside members are accounted for within members' capital on Kimco OP’s financial statements and in noncontrolling interests in the Parent Company’s financial statements.

The Parent Company consolidates Kimco OP for financial reporting purposes, and the Parent Company does not have significant assets other than its investment in Kimco OP. Therefore, while stockholders’ equity, members’ capital and noncontrolling interests differ as discussed above, the assets and liabilities of the Parent Company and Kimco OP are the same on their respective financial statements.

The Company believes combining the Annual Reports on Form 10-K of the Parent Company and Kimco OP into this single report provides the following benefits:

In order to highlight the differences between the Parent Company and Kimco OP, there are sections in this Annual Report that separately discuss the Parent Company and Kimco OP, including separate financial statements (but combined footnotes), separate controls and procedures sections, and separate Exhibit 31 and 32 certifications. In the sections that combine disclosure for the Parent Company and Kimco OP, unless context otherwise requires, this Annual Report refers to actions or holdings of Parent Company and/or Kimco OP as being the actions or holdings of the Company (either directly or through its subsidiaries, including Kimco OP).

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Form 10-K”), together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with the safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,” “project,” “will,” “target,” “plan,” “forecast” or similar expressions. You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which, in some cases, are beyond the Company’s control and could materially affect actual results, performance or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to, (i) financial disruption, changes in trade policies and tariffs, geopolitical challenges or economic downturn, including general adverse economic and local real estate conditions, (ii) the impact of competition, including the availability of acquisition or development opportunities and the costs associated with purchasing and maintaining assets, (iii) the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business, (iv) the reduction in the Company’s income in the event of multiple lease terminations by tenants or a failure of multiple tenants to occupy their premises in a shopping center, (v) the potential impact of e-commerce and other changes in consumer buying practices, and changing trends in the retail industry and perceptions by retailers or shoppers, including safety and convenience, (vi) the availability of suitable acquisition, disposition, development, redevelopment and merger opportunities, and the costs associated with purchasing and maintaining assets and risks related to acquisitions not performing in accordance with our expectations, (vii) the Company’s ability to raise capital by selling its assets, (viii) disruptions and increases in operating costs due to inflation and supply chain disruptions, (ix) risks associated with the development of mixed-use commercial properties, including risks associated with the development, and ownership of non-retail real estate, (x) changes in governmental laws and regulations, including, but not limited to, changes in data privacy, environmental (including climate change), safety and health laws, and management’s ability to estimate the impact of such changes, (xi) valuation and risks related to the Company’s joint venture and preferred equity investments and other investments, (xii) collectability of mortgage and other financing receivables, (xiii) impairment charges, (xiv) criminal cybersecurity attack disruptions, data loss or other security incidents and breaches, (xv) risks related to artificial intelligence, (xvi) impact of natural disasters and weather and climate-related events, (xvii) pandemics or other health crises, (xviii) our ability to attract, retain and motivate key personnel, (xix) financing risks, such as the inability to obtain equity, debt or other sources of financing or refinancing on favorable terms to the Company, (xx) the level and volatility of interest rates and management’s ability to estimate the impact thereof, (xxi) changes in the dividend policy for the Company’s common and preferred stock and the Company’s ability to pay dividends at current levels, (xxii) unanticipated changes in the Company’s intention or ability to prepay certain debt prior to maturity and/or maintain certain debt until maturity, (xxiii) the Company’s ability to continue to maintain its status as a REIT for U.S. federal income tax purposes and potential risks and uncertainties in connection with its UPREIT structure, and (xxiv) other risks and uncertainties identified under Item 1A, “Risk Factors” and elsewhere in this Form 10-K and in the Company’s other filings with the Securities and Exchange Commission (“SEC”). Accordingly, there is no assurance that the Company’s expectations will be realized. The Company disclaims any intention or obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to refer to any further disclosures the Company makes or related subjects in the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K that the Company files with the SEC. Certain forward-looking and other statements in this Annual Report on Form 10-K, or other locations, such as our corporate website, contain various corporate responsibility standards and frameworks (including standards for the measurement of underlying data) and the interests of various stakeholders. As such, such information may not be, and should not be interpreted as necessarily being, “material” under the federal securities laws for SEC reporting purposes, even if we use the word “material” or “materiality” in this document. Corporate Responsibility information is also often reliant on third-party information or methodologies that are subject to evolving expectations and best practices, and our approach to and discussion of these matters may continue to evolve as well. For example, our disclosures may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policies, or other factors, some of which may be beyond our control.

3

PART I

Item 1. Business

Overview

The Company is the leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States. The executive officers are engaged in the day-to-day management and operation of real estate exclusively with the Company, with nearly all operating functions, including leasing, asset management, maintenance, construction, legal, finance and accounting, administered by the Company. The Company’s mission is to create destinations for everyday living that inspire a sense of community and deliver value to our many stakeholders.

The Company began operations through its predecessor, The Kimco Corporation, which was organized in 1966 upon the contribution of several shopping center properties owned by its principal stockholders. In 1973, these principals formed the Company as a Delaware corporation, and, in 1985, the operations of The Kimco Corporation were merged into the Company. The Company completed its initial public stock offering (the “IPO”) in November 1991, and, commencing with its taxable year which began January 1, 1992, elected to qualify as a REIT in accordance with Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”). To qualify as a REIT, the Company must meet several organizational and operational requirements and is required to distribute annually at least 90% of its REIT taxable income, determined without regard to the dividends paid deduction and excluding any net capital gain. In addition, the Company will be subject to federal income tax at regular corporate rates to the extent that it distributes for any year less than 100% of its REIT taxable income, determined without regard to the dividends paid deduction and including any net capital gain. The Company reorganized into an UPREIT structure in January 2023. If, as the Company believes, it is organized and operates in such a manner so as to qualify and remain qualified as a REIT under the Code, the Company generally will not be subject to U.S. federal income tax, provided that distributions to its stockholders equal at least the amount of its REIT taxable income, as defined in the Code. The Company maintains certain subsidiaries that made joint elections with the Company to be treated as taxable REIT subsidiaries (“TRSs”). This permits the Company to engage in certain business activities that a REIT may not conduct directly, by conducting such business activities through such TRSs. A TRS is subject to federal and state taxes on its income, and the Company includes a provision for taxes in its consolidated financial statements. In 1994, the Company's predecessor reorganized as a Maryland corporation. In March 2006, the Company was added to the S&P 500 Index, an index containing the stock of 500 Large Cap companies, most of which are U.S. corporations. The Company's common stock, Class L Depositary Shares, Class M Depositary Shares, and Class N Depositary Shares are traded on the New York Stock Exchange (“NYSE”) under the trading symbols “KIM”, “KIMprL”, “KIMprM” and “KIMprN”, respectively.

The Company is a self-administered REIT and has owned and operated open-air shopping centers for over 65 years. The Company has not engaged, nor does it expect to retain, any REIT advisors in connection with the operation of its properties. The Company’s ownership interests in real estate consist of its consolidated portfolio and portfolios where the Company owns an economic interest, such as properties in the Company’s investment real estate management programs, where the Company partners with institutional investors and also retains management.

The Company began to expand its operations through the development of real estate and the construction of shopping centers but revised its growth strategy to focus on the acquisition and redevelopment of existing shopping centers that include a grocery component. Additionally, the Company has developed, and continues to develop, various residential and mixed-use operating properties, as well as obtain entitlements to embark on additional projects of this nature through re-development opportunities.

On January 2, 2024, RPT Realty (“RPT”) merged with and into the Company, with the Company continuing as the surviving public company (the “RPT Merger”), pursuant to the definitive merger agreement (the “Merger Agreement”) between the Company and RPT, entered into on August 28, 2023. The RPT Merger added 56 open-air shopping centers, 43 of which were wholly-owned and 13 of which were owned through a joint venture, comprising 13.3 million square feet of gross leasable area ("GLA"). In addition, as a result of the RPT Merger, the Company obtained RPT’s 6% stake in a 49-property net lease joint venture. See Footnote 2 of the Notes to Consolidated Financial Statements for further details on the RPT Merger.

The Company has implemented its investment real estate management format through the establishment of various institutional joint venture programs, in which the Company has noncontrolling interests. The Company earns management fees, acquisition fees, disposition fees as well as promoted interests based on achieving certain performance metrics.

In addition, the Company has capitalized on its established expertise in retail real estate by establishing other ventures in which the Company owns a smaller equity interest and provides management, leasing and operational support for those properties. The Company has also provided preferred equity capital to real estate professionals and, from time to time, provides real estate capital, retail real estate financing and management services to both healthy and distressed retailers. The Company has also made selective investments in

4

secondary market opportunities where a security or other investment is, in management’s judgment, priced below the value of the underlying assets, however, these investments are subject to volatility within the equity and debt markets.

At December 31, 2025, the Parent Company is the managing member of Kimco OP and owns 99.79% of the limited liability company interests of, and exercises exclusive control over, Kimco OP as described in detail in the Explanatory Note to this Form 10-K.

As of December 31, 2025, the Company had interests in 565 shopping center properties, aggregating 100.2 million square feet of GLA, located in 29 states. In addition, the Company had 66 other property interests, primarily including net leased properties, preferred equity investments, and other investments, totaling 5.4 million square feet of GLA.

Economic Uncertainty

The economy continues to face challenges, which could adversely impact the Company and its tenants, including elevated inflation and interest rates, tenant bankruptcies, tariffs or other trade restrictions, geopolitical uncertainties and government shutdowns. These factors could slow economic growth and materially increase the cost of goods and services offered by the Company’s tenants, leading to lower profits. To the extent our tenants are unable to pass these costs on to their customers, our tenants’ operations could be adversely impacted, which could result in tenant bankruptcies, amongst other things, and could weaken demand by those tenants for our real estate and adversely impact the Company. In addition, these challenges could negatively affect the overall demand for retail space, including the demand for leasable space in the Company’s properties. Any of these factors could materially adversely impact the Company’s business, financial condition, results of operations or stock price. The Company continues to monitor economic, financial, and social conditions and will assess its asset portfolio for any impairment indicators. If the Company determines that any of its assets are impaired, the Company would be required to take impairment charges, and such amounts could be material.

Business Objective and Strategies

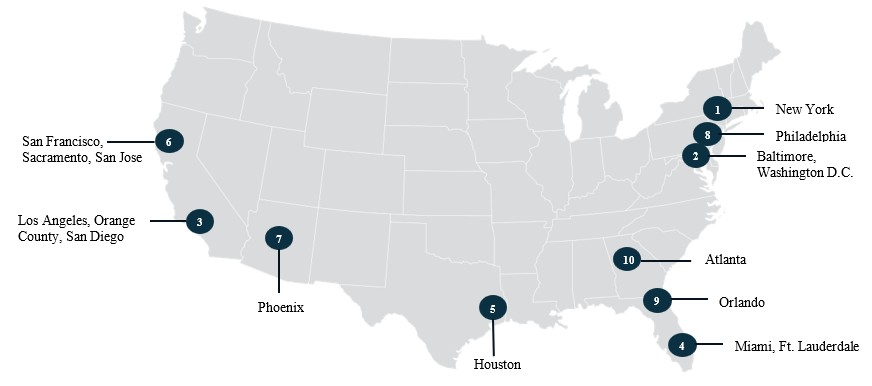

The Company has developed a strong nationally diversified portfolio of open-air, grocery anchored shopping centers located in drivable first-ring suburbs primarily within 19 major metropolitan Sun Belt and coastal markets, which are supported by strong demographics, significant projected population growth, and where the Company perceives significant barriers to entry. As of December 31, 2025, the Company derived 82% of its proportionate share of annualized base rental revenues from these top major metro markets. The Company’s shopping centers provide essential, necessity-based goods and services to the local communities and are primarily anchored by a grocery store, home improvement center, off-price retailer, discounter and/or service-oriented tenant.

The Company’s focus on high-quality locations has led to significant opportunities for value creation through the reinvestment in its assets to add density, replace outdated shopping center concepts, and better meet changing consumer demands. In order to add density to existing properties, the Company has obtained multi-family entitlements for 14,196 units, of which 3,505 units have been constructed as of December 31, 2025. The Company continues to place strategic emphasis on live/work/play environments and in reinvesting in its existing assets, while building shareholder value.

The Company's focus on open-air shopping centers designed to deliver elevated retail experiences and drive superior tenant performance is demonstrated by the Company's Lifestyle CollectionTM. Each upscale property in this curated portfolio features thoughtfully designed common areas, experiential programming, premium fashion and lifestyle brands, and elevated food and beverage offerings alongside everyday essentials - resulting in increased foot traffic, longer dwell times, and stronger tenant sales. Every center in the Lifestyle Collection is intentionally crafted to reflect the unique identity and aspirations of our brand partners, catering to a sophisticated consumer base through a thoughtfully composed tenant mix and a strong sense of place. Beyond the individual assets, the Lifestyle Collection serves as a gateway to the Company's broader national footprint, offering growth-minded brands a seamless path to scale within the open-air retail space. This integrated approach strengthens long-term partnerships and maximizes visibility, impact, and success for our tenants across the evolving retail landscape.

The strength and security of the Company’s balance sheet remains central to its strategy. The Company’s strong balance sheet and liquidity position are evidenced by its investment grade unsecured debt ratings (A-/A-/A3) by three major ratings agencies. The Company maintains one of the longest weighted average debt maturity profiles in the REIT industry, now at 7.9 years. The Company expects to continue to operate in a manner that fosters strong debt and fixed charge coverage metrics.

Business Objective

The Company’s primary business objective is to be the premier owner and operator of open-air, grocery-anchored shopping centers, and mixed-use assets, in the U.S. The Company believes it can achieve this objective by:

5

Business Strategies

The Company believes it is well positioned to achieve sustainable growth, with its strong core portfolio and its recent acquisitions allowing the Company to achieve higher occupancy levels, increased rental rates and rental growth in the future. To further achieve the Company's business objectives it has identified the following strategic goals:

The Company has identified the following four strategic pillars, which the Company believes positions it for sustainable growth in the future.

High Quality, Diversified Portfolio |

|

|

• Well positioned, grocery anchored portfolio in major Sun Belt and coastal markets, with 91% of the portfolio within the Sun Belt and/or coastal markets • Provide critical last-mile solution to its diverse pool of tenants |

|

|

|

|

Accretive Capital Allocation |

|

|

• Generate additional internal and external growth through accretive acquisitions and (re)development • Growth through a curated collection of mixed-use projects and redevelopments • Opportunistic acquisition and structured investment platform (“Plus”) business focused on accretive unique opportunities |

|

|

|

|

Significant Financial Strength |

|

|

• Maintain a strong balance sheet and liquidity position with an emphasis on reduced leverage and a sustainable and growing dividend • Over $2.2 billion of immediate liquidity, including the Company's $2.0 billion unsecured revolving credit facility • 7.9-year consolidated weighted average debt maturity profile • Over 525 unencumbered properties, representing approximately 91% of the centers in the Company's portfolio |

|

|

|

|

Corporate Responsibility Leadership |

|

|

• Over 65 years of delivering value to investors, tenants, employees, and communities • Corporate Responsibility approach is aligned with core business strategy • Proactive approach to assessing, disclosing and managing climate, reputational and other risks |

The Company reduces its operating and leasing risks through diversification achieved by the geographic distribution of its properties and a large tenant base. As of December 31, 2025, no single open-air shopping center accounted for more than 1.2% of the Company's annualized base rental revenues, including the proportionate share of base rental revenues from properties in which the Company has less than a 100% economic interest, or more than 1.3% of the Company’s total shopping center GLA. Furthermore, at December 31, 2025, the Company’s single largest tenant represented only 3.8%, and the Company’s five largest tenants aggregated to only 10.9%, of the Company’s annualized base rental revenues, including the proportionate share of base rental revenues from properties in which the Company has less than a 100% economic interest.

6

As one of the original participants in the growth of the shopping center industry and the nation's largest owner and operator of open-air shopping centers, the Company has established close relationships with major national and regional retailers and maintains a broad network of industry contacts. Management is associated with and/or actively participates in many shopping center and REIT industry organizations. Notwithstanding these relationships, there are numerous regional and local commercial developers, real estate companies, financial institutions and other investors who compete with the Company for the acquisition of properties and other investment opportunities and in seeking tenants who will lease space in the Company’s properties.

The Company’s executive and senior management teams are seasoned real estate operators with extensive retail and public company leadership experience. The Company’s management has a deep industry knowledge and well-established relationships with retailers, brokers, and vendors through many years of operational and transactional experience, as well as significant capital markets capabilities. The Company believes that management’s expertise, experience, reputation, and key relationships in the retail real estate industry provides it with a significant competitive advantage in attracting new business opportunities.

Government Regulation

Compliance with various governmental regulations has an impact on our business, including our capital expenditures, earnings and competitive position, which can be material. We incur costs to monitor and take actions to comply with governmental regulations that are applicable to our business, which include, among others, federal securities laws and regulations, applicable stock exchange requirements, international tariffs and other trade restrictions, REIT and other tax laws and regulations, environmental and health and safety laws and regulations, local zoning, usage and other regulations relating to real property and the Americans with Disabilities Act of 1990.

On July 4, 2025, the One Big Beautiful Bill Act (the “OBBBA”) was enacted into law, which included certain modifications to U.S. tax law, including certain provisions that affect the taxation of REITs and their investors. The OBBBA permanently extended certain provisions that were enacted in the Tax Cuts and Jobs Act of 2017 and were generally set to expire for taxable years beginning after December 31, 2025. Such extensions included the permanent extension of the 20% deduction for “qualified REIT dividends” for individuals and other non-corporate taxpayers. The OBBBA also increased the percentage limit under the REIT asset test applicable to TRSs (the permissible value of TRS securities that a REIT may hold) from 20% to 25% of the value of the REIT’s total assets for taxable years beginning after December 31, 2025. The OBBBA did not have a material impact on the Company’s financial condition and/or results of operations.

In addition, see Item 1A. Risk Factors for a discussion of material risks to us, including, to the extent material, to our competitive position, relating to governmental regulations, and see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” together with our audited consolidated financial statements and the related notes thereto for a discussion of material information relevant to an assessment of our financial condition and results of operations, including, to the extent material, the effects that compliance with governmental regulations may have upon our capital expenditures and earnings.

Human Capital Resources

The Company believes that its associates are one of its strongest resources. The Company is committed to best practices in all phases of the associate life cycle, including recruitment, training, development and promotion. By cultivating high levels of associate satisfaction, management’s goal is to ensure the Company remains a significant driving force in commercial real estate well into the future.

The Company is an equal opportunity employer committed to hiring, developing, and supporting a collaborative workforce. The Company takes steps to support its commitment that employment decisions (including how persons are recruited, hired, assigned and promoted) are not made on the basis of any legally protected characteristic. All of our employees must adhere to a Code of Business Conduct and Ethics that sets standards for appropriate behavior and includes required, regular internal training on preventing, identifying, reporting and stopping any type of discrimination and/or retaliation.

To attract and retain high performing individuals, we are committed to partnering with our associates to provide opportunities for their professional development and promote their health and well-being. We offer a broad range of benefits, and we believe our compensation package and benefits are competitive with others in our industry. In addition to base salary, many of our associates participate in an annual bonus plan and receive annual equity awards. Our benefits programs include a robust offering of medical, dental, vision, life, disability and a number of exciting ancillary benefits, all of which require modest associate contributions or are offered at no cost to associates. The Company also provides a Safe Harbor 401(k) program with both pretax and Roth offerings including a robust, fully vested matching contribution.

The Company has earned Great Place to Work certification for eight consecutive years and has been recognized as a recipient of Best Workplaces in Real Estate, Best Workplaces in New York, and Best Workplaces for Millennials.

7

The Company operates under a hybrid work model, which balances valuable face-to-face interactions with individual preferences for ideal work conditions. By focusing on communication, collaboration, and innovation, and by encouraging associates to be deliberate in where and how they choose to work, the model results in an engaged, satisfied and efficient workforce.

The Company’s executive and management team promotes a true “open door” environment in which all feedback and suggestions are welcome. Whether it be through regular face-to-face discussion, all employee calls, department meetings, frequent training sessions, Coffee Connections with the executive team, use of our BRAVO recognition program, participation in our leadership development programs, or suggestions through the Company's internet portal, associates are encouraged to be inquisitive and share ideas. Those ideas have resulted in a number of programs and benefit enhancements.

The Company promotes physical and mental health, including access to a national gym membership program and no cost access to numerous health and wellness applications for associates and their family members. It supports an internal Wellness Council and hosts regular wellness and nutrition seminars and health screenings.

Engaging in the community is important to the Company and its associates. Across the Company's numerous offices, associates host volunteer and social activities. The Company promotes and supports associate volunteerism with two volunteer days off per year and a Company matching program in support of each associate's charitable endeavors. Employees may participate in KIMunity Councils focused in the areas of culture, charitable and in-kind giving, wellness, sustainability, and tenant engagement.

The Company's executive offices are located at 500 North Broadway, Suite 201, Jericho, NY 11753, a mixed-use property that is wholly-owned by the Company, and its telephone number is 516-869-9000 or 1-800-764-7114. Nearly all corporate functions, including legal, data processing, finance and accounting are administered by the Company from its executive offices in Jericho, New York and supported by the Company’s regional offices. As of December 31, 2025, a total of 710 persons were employed by the Company, of which 32% were located in our corporate office with the remainder located in 30 offices throughout the United States or working remotely. The average tenure of our employees was 10.1 years.

Corporate Responsibility Programs

The Company strives to build a thriving and viable business, one that succeeds by delivering long-term value for its stakeholders. We believe that the Company’s Corporate Responsibility programs are aligned with its core business strategy of creating destinations for everyday living that inspire a sense of community and deliver value to its many stakeholders.

The Company’s Board of Directors sets the objectives for Company’s overall Corporate Responsibility programs and oversees enterprise risk management. The Nominating and Corporate Governance Committee of the Board of Directors is responsible for overseeing the Company’s efforts with regard to the Company’s Corporate Responsibility matters.

As a real estate portfolio owner, the Company works to monitor physical and transition risks as well as opportunities posed to its business by climate change and quantifies and discloses the climate information regarding its activities. Climate risks and opportunities are generally evaluated at both the corporate and individual asset level. The following table summarizes relevant climate risks identified as a part of the Company’s ongoing risk assessment process. The Company may be subject to other climate risks not included below.

8

Climate Risk |

Description |

|

Physical Risk |

|

|

|

Acute Hazards - Windstorms |

Increased frequency and intensity of windstorms, such as hurricanes, could lead to property damage, loss of property value, increased operating and capital costs and insurance premiums, and interruptions to business operations. |

|

Acute Hazards - Flooding |

Change in rainfall conditions leading to increased frequency and severity of flooding could lead to property damage, loss of property value, increased operating and capital costs and insurance premiums, and interruptions to business operations. |

|

Acute Hazards and Chronic Stressors - Wildfires |

Change in fire potential could lead to permanent loss of property, stress on human health (air quality) and stress on ecosystem services. |

|

Chronic Stressors - Sea Level Rise |

Rising sea levels could lead to storm surge and other potential impacts for low-lying coastal properties leading to damage, loss of property value, increased operating and capital costs and insurance premiums, and interruptions to business operations. |

|

Chronic Stressors - Heat and Water Stress |

Increases in temperature could lead to droughts and decreased available water supply could lead to higher utility usage and supply interruptions. |

Transition Risk |

|

|

|

Policy and Legal |

Regulations at the federal, state and local levels, in addition to stakeholder adherence to international regulations, could impose additional operating and capital costs associated with utilities, energy efficiency, building materials and building design. |

|

Reputation and Market |

Increased interest among retail tenants in building efficiency, sustainable design criteria and "green leases," which incorporate provisions intended to promote sustainability at the property, could result in decreased demand for outdated space. Potential for fluctuating costs for carbon intensive raw materials used to construct and renovate properties. |

|

Technology |

Increasing market and regulatory expectations may result in increased investment in upgrading technology and assets, including training and startup costs. |

The Company’s approach in mitigating these risks includes, but is not limited to (i) carrying additional insurance coverage relating to flooding and windstorms, (ii) maintaining a geographically diversified portfolio, which limits exposure to event driven risks, (iii) creating a form “green lease” for its tenants, which incorporates varied criteria that align landlord and tenant sustainability priorities as well as establishing green construction criteria and (iv) implementing emergency preparedness and operational energy and water efficiency programs.

In 2020, the Company issued $500.0 million in 2.70% notes due 2030 in its first green bond offering. The net proceeds were allocated to finance or refinance eligible green projects, aligned with the Green Bond Principles, 2018 as administered by the International Capital Market Association. As of June 30, 2024, the Company reached full allocation of the $500.0 million green bond. Additionally, the Company’s $2.0 billion Credit Facility is a green credit facility, which incorporates rate adjustments associated with attainment (or non-attainment) of Scope 1 and 2 greenhouse gas ("GHG") emissions reductions. The Company, at December 31, 2025, also has a credit agreement in which $310.0 million in term loans have rate adjustments that are also tied to the attainment (or non-attainment) of Scope 1 and 2 GHG emissions. During 2025, the Company attained the Scope 1 and 2 GHG emissions targets and achieved the maximum interest rate adjustment to its Credit Facility and certain of its term loans.

Additional information about our approach to corporate responsibility, including our corporate responsibility targets, is available in our Corporate Responsibility Report, which can be found on the Company’s website. Such information is not incorporated by reference into, and is not part of, this annual report on Form 10-K.

Information About Our Executive Officers

The following table sets forth information with respect to the executive officers of the Company as of December 31, 2025:

Name |

|

Age |

|

Position |

|

Joined Kimco |

Conor C. Flynn |

|

45 |

|

Chief Executive Officer and Director |

|

2003 |

Ross Cooper |

|

43 |

|

President, Chief Investment Officer and Director |

|

2006 |

Glenn G. Cohen |

|

61 |

|

Executive Vice President, Chief Financial Officer |

|

1995 |

David Jamieson |

|

45 |

|

Executive Vice President, Chief Operating Officer |

|

2007 |

Available Information

The Company’s website is located at http://www.kimcorealty.com. The information contained on our website does not constitute part of this Form 10-K. On the Company’s website you can obtain, free of charge, a copy of this Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable, after we file such material electronically with, or furnish it to, the SEC. The public may read and obtain a copy of any materials we file electronically with the SEC at http://www.sec.gov.

9

Item 1A. Risk Factors

We are subject to certain business and legal risks, including, but not limited to, the following:

Risks Related to Our Business and Operations

Adverse global market and economic conditions may impede our ability to generate sufficient income and maintain our properties.

Our properties consist primarily of open-air shopping centers, including mixed-use assets, and other retail properties. Our performance, therefore, is generally linked to economic conditions in the market for retail space. The economic performance and value of our properties is subject to all of the risks associated with owning and operating real estate, including, but not limited to:

Competition may limit our ability to purchase new properties or generate sufficient income from tenants and may decrease the occupancy and rental rates for our properties.

Numerous commercial developers and real estate companies compete with us in seeking tenants for our existing properties and properties for acquisition. Open-air shopping centers, including mixed-use assets, or other retail shopping centers with more convenient locations or better rents may attract tenants or cause them to seek more favorable lease terms at or prior to renewal. Retailers at our properties may face increasing competition from other retailers, e-commerce, outlet malls, discount shopping clubs, and other forms of marketing goods, such as direct mail and internet marketing, all of which could (i) reduce rents payable to us, (ii) reduce our ability to attract and retain tenants at our properties; or (iii) lead to increased vacancy rates at our properties. We may fail to anticipate the effects of changes in consumer buying practices, particularly of growing online sales and the resulting retailing practices and space needs of our tenants or a general downturn in our tenants’ businesses, which may cause tenants to close stores or default in payment of rent.

We face competition in the acquisition or development of real property from others engaged in real estate investment that could increase our costs associated with purchasing and maintaining assets. Some of these competitors may have greater financial resources than we do. This could result in competition for the acquisition of properties for tenants who lease or consider leasing space in our existing and subsequently acquired properties and for other investment or development opportunities.

Our performance depends on our ability to collect rent from tenants, our tenants’ financial condition and our tenants maintaining leases for our properties.

At any time, our tenants may experience a downturn in their business that may significantly weaken their financial condition. As a result, our tenants may delay a number of lease commencements, decline to extend or renew leases upon expiration, fail to make rental payments when due, close stores or declare bankruptcy. Any of these actions, which have impacted us and will continue to impact us from time

10

to time, could result in the termination of tenants’ leases and the loss of rental income attributable to these tenants’ leases. In the event of a default by a tenant, we may experience delays and costs in enforcing our rights as landlord under the terms of the leases.

In addition, multiple lease terminations by tenants, or a failure by multiple tenants to occupy their premises in a shopping center could result in lease terminations or significant reductions in rent by other tenants in the same shopping centers under the terms of some leases. In that event, we may be unable to re-lease the vacated space at attractive rents or at all, and our rental payments from our continuing tenants could significantly decrease. The occurrence of any of the situations described above, particularly involving a substantial tenant with leases in multiple locations, could have a material adverse effect on our financial condition, results of operations and cash flows.

A tenant that files for bankruptcy protection may not continue to pay us rent. A bankruptcy filing by, or relating to, one of our tenants or a lease guarantor would bar all efforts by us to collect pre-bankruptcy debts from the tenant or the lease guarantor, or their property, unless the bankruptcy court permits us to do so. A tenant bankruptcy could delay our efforts to collect past due balances under the relevant leases and could ultimately preclude collection of these sums. If a lease is rejected by a tenant in bankruptcy, we would have only a general unsecured claim for damages. As a result, it is likely that we would recover substantially less than the full value of any unsecured claims we hold, if at all.

Current geopolitical challenges could impact the U.S. economy and consumer spending and our results of operations and financial condition. The success of our business, and the success of our tenants in operating their businesses and their corresponding ability to pay us rent continue to be significantly impacted by many current economic challenges, which impact the performance of their businesses, including, but not limited to, inflation, labor shortages, including as a result of changes in immigration laws or their enforcement, tariffs or other trade restrictions, supply chain constraints, decreasing consumer confidence and discretionary spending, and elevated energy prices and interest rates.

E-commerce and other changes in consumer buying practices present challenges for many of our tenants and may require us to modify our properties, diversify our tenant composition and adapt our leasing practices to remain competitive.

Many of our tenants face strong competition from e-commerce and other sources that could cause them to reduce their size, limit the number of locations and/or suffer a general downturn in their businesses and ability to pay rent. We may also fail to anticipate the effects of changes in consumer buying practices, particularly of online sales and the resulting change in retailing practices and space needs of our tenants, which could have an adverse effect on our results of operations and cash flows. We are focused on anchoring and diversifying our properties with tenants that are more resistant to competition from e-commerce (e.g., groceries, essential retailers, restaurants and service providers), but there can be no assurance that we will be successful in modifying our properties, diversifying our tenant composition and/or adapting our leasing practices.

Our expenses may remain constant or increase, even if income from our real estate portfolio decreases, which could adversely affect our financial condition, results of operations and cash flows.

Costs associated with our business, such as common area expenses, utilities, insurance, real estate taxes, mortgage payments, and corporate expenses are relatively inflexible and generally do not decrease in the event that a property is not fully occupied, rental rates decrease, a tenant fails to pay rent or other circumstances cause our revenues to decrease. In addition, elevated or increased inflation could result in higher operating costs. If we are unable to lower our operating costs when revenues decline and/or are unable to pass along cost increases to our tenants, our financial condition, results of operations and cash flows could be adversely impacted.

We may be unable to sell our real estate property investments when appropriate or on terms favorable to us.

Real estate property investments are illiquid and generally cannot be disposed of quickly. The capitalization rates at which properties may be sold could be higher than historic rates, thereby reducing our potential proceeds from sale. In addition, the Code includes certain restrictions on a REIT’s ability to dispose of properties that are not applicable to other types of real estate companies. Therefore, we may not be able to vary our portfolio in response to economic or other conditions promptly or on terms favorable to us within a time frame that we would need. All of these factors reduce our ability to respond to changes in the performance of our investments and could adversely affect our business, financial condition and results of operations.

Certain properties we own have a low tax basis, which may result in a taxable gain on sale. We may utilize like-kind exchanges qualifying under Section 1031 of the Code (“1031 Exchanges”) to mitigate taxable income; however, there can be no assurance that we will identify properties that meet our investment objectives for acquisitions. In the event that we do not utilize 1031 Exchanges, we may be required to distribute the gain proceeds to shareholders or pay income tax, which may reduce our cash flow available to fund our commitments.

From time to time, we acquire or develop properties or acquire other real estate related companies, and this creates risks.

11

We acquire or develop properties or acquire other real estate related companies when we believe that an acquisition or development is consistent with our business strategies. We may not succeed in consummating desired acquisitions or in completing developments on time or within budget. When we do pursue a project or acquisition, we may not succeed in leasing newly developed or acquired properties at rents sufficient to cover the costs of acquisition or development and operations. Difficulties in integrating acquisitions may prove costly or time-consuming and could divert management’s attention from other activities. Acquisitions or developments in new markets or industries where we do not have the same level of market knowledge may result in poorer than anticipated performance. We may also abandon acquisition or development opportunities that management has begun pursuing and consequently fail to recover expenses already incurred and will have devoted management’s time to a matter not consummated. Furthermore, our acquisitions of new properties or companies will expose us to the liabilities of those properties or companies, some of which we may not be aware of at the time of the acquisition. In addition, development of our existing properties presents similar risks.

Newly acquired or re-developed properties may have characteristics or deficiencies currently unknown to us that affect their value or revenue potential. It is also possible that the operating performance of these properties may decline under our management. As we acquire additional properties, we will be subject to risks associated with managing new properties, including lease-up and tenant retention. In addition, our ability to manage our growth effectively will require us to successfully integrate our new acquisitions into our existing management structure. We may not succeed with this integration or effectively manage additional properties, particularly in secondary markets. Also, newly acquired properties may not perform as expected.

We face risks associated with the development of mixed-use commercial properties.

We operate, are currently developing, and may in the future develop, properties either alone or through joint ventures and preferred equity investments with other persons that are known as “mixed-use” developments. This means that, in addition to the development of retail space, the project may also include space for residential, office, hotel or other commercial purposes. We have less experience in developing and managing non-retail real estate than we do with retail real estate. As a result, if a development project includes a non-retail use, we may seek to develop that component ourselves, sell the rights to that component to a third-party developer with experience developing properties for such use or partner with such a developer. If we do not sell the rights or partner with such a developer, or if we choose to develop the other component ourselves, we would be exposed not only to those risks typically associated with the development of commercial real estate generally, but also to specific risks associated with the development and ownership of non-retail real estate. In addition, even if we sell the rights to develop the other component or elect to participate in the development through a joint venture and preferred equity investments, we may be exposed to the risks associated with the failure of the other party to complete the development as expected. These include the risk that the other party would default on its obligations necessitating that we complete the other component ourselves, including providing any necessary financing. In the case of residential properties, these risks include competition for prospective residents from other operators whose properties may be perceived to offer a better location or better amenities or whose rent may be perceived as a better value given the quality, location and amenities that the resident seeks. We will also compete against condominiums and single-family homes that are for sale or rent. In the case of office properties, the risks also include changes in space utilization by tenants due to technology, economic conditions and business culture, declines in financial condition of these tenants and competition for credit worthy office tenants. In the case of hotel properties, the risks also include elevated or increased inflation and utilities that may not be offset by increases in room rates. We are also dependent on business and commercial travelers and tourism. Because we have less experience with residential, office and hotel properties than with retail properties, we expect to retain third parties to manage our residential and other non-retail components as deemed warranted. If we decide to not sell or participate in a joint venture or preferred equity investment and instead hire a third-party manager, we would be dependent on them and their key personnel who provide services to us, and we may not find a suitable replacement if the management agreement is terminated, or if key personnel leave or otherwise become unavailable to us.

Construction projects are subject to risks that materially increase the costs of completion.

From time to time, we decide to develop a vacant land parcel or redevelop existing properties, which subjects us to risks and uncertainties associated with construction and development. These risks include, but are not limited to, risks related to obtaining all necessary zoning, land-use, building occupancy and other governmental permits and authorizations, risks related to the environmental concerns of government entities or community groups, risks related to changes in economic and market conditions, especially in an inflationary environment, between development commencement and stabilization, risks related to construction labor disruptions, adverse weather, natural disasters, acts of God or shortages of materials and labor, which could cause construction delays and risks related to increases in the cost of labor and materials, which could cause construction costs to be greater than projected and adversely impact the amount of our development fees or our financial condition, results of operations and cash flows.

12

Supply chain disruptions and unexpected construction expenses and delays could impact our ability to timely deliver spaces to tenants and/or our ability to achieve the expected value of a construction project or lease, thereby adversely affecting our profitability.

The construction and building industry, similar to many other industries, is experiencing worldwide supply chain disruptions due to a multitude of factors that are beyond our control. Materials, parts and labor have also increased in cost over the past year or more, sometimes significantly and over a short period of time. We may incur costs for a property renovation or tenant buildout that exceeds our original estimates due to increased costs for materials or labor or other costs that are unexpected. We also may be unable to complete renovation of a property or tenant space on schedule due to supply chain disruptions or labor shortages, including as a result of changes in immigration laws or their enforcement, which could result in increased debt service expense or construction costs. Additionally, some tenants may have the right to terminate their leases if a renovation project is not completed on time. The time frame required to recoup our renovation and construction costs and to realize a return on such costs can often be significant and materially adversely affect our profitability.

International trade disputes, including U.S. trade tariffs and retaliatory tariffs, could adversely impact our business.

International trade disputes, including threatened or implemented tariffs imposed by the U.S. and threatened or implemented tariffs imposed by foreign countries in retaliation, have adversely impacted and in the future could adversely impact our business. Many of our tenants sell imported goods, and tariffs or other trade restrictions have materially increased costs for these tenants and could continue to materially increase costs in the future. To the extent our tenants are unable to pass these costs on to their customers, our tenants’ operations have been, and in the future could be, adversely impacted, which among other things, could weaken demand by those tenants for our real estate. If the operations of potential future tenants are similarly adversely impacted, overall demand for our real estate may also weaken. In addition, international trade disputes, including those related to tariffs, have resulted and in the future could result in inflationary pressures that directly impact our costs, such as costs for steel, lumber and other materials applicable to our redevelopment projects. Trade disputes have adversely impacted global supply chains which could further increase costs for us and our tenants or delay delivery of key inventories and supplies.

The Americans with Disabilities Act of 1990 could require us to take remedial steps with respect to existing or newly acquired properties.

Our existing properties, as well as properties we may acquire, as commercial facilities, are required to comply with Title III of the Americans with Disabilities Act of 1990 (the “ADA”). Investigation of a property may reveal non-compliance with the ADA. The requirements of the ADA, or of other federal, state or local laws or regulations, also may change in the future and restrict further renovations of our properties with respect to access for disabled persons. From time to time, we have made changes to properties to comply with the ADA, and future compliance with the ADA may require expensive changes to our properties.

We do not have exclusive control over our joint venture and preferred equity investments, such that we are unable to ensure that our objectives will be pursued.

We have invested in some properties as a co-venturer or a partner, instead of owning directly. In these investments, we do not have exclusive control over the development, financing, leasing, management and other aspects of these investments. As a result, the co-venturer or partner might have interests or goals that are inconsistent with ours, take action contrary to our interests or otherwise impede our objectives. These investments involve risks and uncertainties. The co-venturer or partner may fail to provide capital or fulfill its obligations, which may result in certain liabilities to us for guarantees and other commitments. Conflicts arising between us and our partners may be difficult to manage and/or resolve, and it could be difficult to manage or otherwise monitor the existing business arrangements. The co-venturer or partner also might become insolvent or bankrupt, which may result in significant losses to us.

In addition, joint venture arrangements may decrease our ability to manage risk and implicate additional risks, such as:

13

Our joint venture and preferred equity investments generally own real estate properties for which the economic performance and value are subject to all the risks associated with owning and operating real estate as described above.

We may not be able to recover our investments in mortgage and other financing receivables or other investments, which may result in significant losses to us.

Our investments in mortgage and other financing receivables are subject to specific risks relating to the borrower and the underlying collateral. In the event of a default by a borrower, it may be necessary for us to foreclose our mortgage or engage in costly negotiations. Delays in liquidating defaulted mortgage loans and repossessing and selling the underlying properties could reduce our investment returns. Furthermore, in the event of default, the actual value of the property collateralizing the mortgage may decrease. A decline in real estate values will adversely affect the value of our loans and the value of the properties collateralizing our loans.

Our mortgage receivables may be or become subordinated to mechanics' or materialmen's liens or property tax liens. In these instances, we may need to protect a particular investment by making payments to maintain the current status of a prior lien or discharge it entirely. Where that occurs, the total amount we recover may be less than our total investment, resulting in a loss. In the event of a major loan default or several loan defaults resulting in losses, our investments in mortgage receivables would be materially and adversely affected.

The economic performance and value of our other investments, which we do not control, are subject to risks associated with owning and operating retail businesses, including:

The Company is required under generally accepted accounting principles in the United States of America (“GAAP”) to provide allowances for credit losses, under the current expected credit loss model (“CECL”), on certain financial assets carried at amortized cost, such as loans held-for-investment and held-to-maturity debt securities, including related future funding commitments and accrued interest receivable. The measurement of expected credit losses is based on information about past events, including historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amount. This measurement takes place at the time the financial asset is first added to the balance sheet and updated quarterly thereafter. This differs significantly from the “incurred loss” model previously required under GAAP, which delayed recognition until it was probable a loss had been incurred. The CECL model has affected, and will continue to affect, how we determine our credit loss provision and has required us, and could continue to require us, to significantly increase our allowance for credit losses and recognize provisions for credit losses earlier in the lending cycle. Moreover, the CECL model creates more volatility in the level of our credit loss provisions. If we are required to materially increase our future level of credit loss allowances for any reason, such increase could adversely affect our business, results of operations and financial condition.

Our real estate assets may be subject to impairment charges.

We periodically assess whether there are any indicators that the value of our real estate assets may be impaired. A property’s value is considered to be impaired only if the estimated aggregate future undiscounted property cash flows are less than the carrying value of the property. In our estimate of cash flows, we consider factors such as trends and prospects and the effects of demand and competition on expected future operating income. If we are evaluating the potential sale of an asset or redevelopment alternatives, the undiscounted future cash flows consider the most likely course of action as of the balance sheet date based on current plans, intended holding periods and available market information. We are required to make subjective assessments as to whether there are impairments in the value of our real estate assets. There can be no assurance that we will not take additional charges in the future related to the impairment of our assets. Impairment charges upon recognition could have a material adverse effect on our results of operations in the period in which the charge is taken.

We may not be able to recover our investments, which may result in significant losses to us.

There can be no assurance that we will be able to recover the current carrying amount of all of our properties and investments and those of our unconsolidated joint ventures in the future. Our failure to do so would require us to recognize impairment charges for the period in which we reached that conclusion, which could materially and adversely affect our financial condition, results of operations and cash flows.

We have completed our efforts to exit Mexico and Canada, however, we cannot predict the impact of laws and regulations affecting these international operations, including the United States Foreign Corrupt Practices Act, or the potential that we may face regulatory sanctions.

14

Our international operations had included properties in Mexico and Canada and are subject to a variety of United States and foreign laws and regulations, including the United States Foreign Corrupt Practices Act and foreign tax laws and regulations. Although we have completed our efforts to exit our investments in Mexico and Canada, we cannot assure you that our past practices will continue to be found to be in compliance with such laws or regulations. In addition, we cannot predict the manner in which such laws or regulations might be administered or interpreted, or when, or the potential that we may face regulatory sanctions or tax audits as a result of our former international operations.

Cybersecurity attacks and incidents could materially impact our business, financial condition and results of operations.

Our information technology (“IT”) networks and related systems are essential to the operation of our business and our ability to perform day-to-day operations and, in some cases, may be critical to the operations of certain of our tenants. While we maintain some of our own critical IT networks and related systems, we also depend on third parties to provide important software, technologies, tools and a broad array of services and operational functions, including payroll, human resources, electronic communications and finance functions. In the ordinary course of our business, we and our third-party service providers collect, process, transmit and store sensitive information and data, including intellectual property, our proprietary business information and that of our customers, suppliers and business partners, as well as personally identifiable information.

We, and our third-party service providers, like all businesses, are subject to cyberattacks and security incidents that threaten the confidentiality, integrity, and availability of our IT systems and information resources. Cyberattacks and security incidents include intentional or unintentional acts by employees, customers, contractors or third parties, who seek to gain unauthorized access to our or our service providers’ systems to disrupt operations, corrupt data, or steal confidential or personal information through malware, computer viruses, ransomware, software or hardware vulnerabilities, social engineering (e.g., phishing attachments to e-mails) or other vectors.

Cyberattacks are becoming more challenging to identify, investigate and remediate, because attackers increasingly use techniques and tools, including artificial intelligence, that circumvent controls, avoid detection, and remove or obscure forensic evidence, including as a result of the intensification of state-sponsored cybersecurity attacks during periods of geopolitical conflict. There can be no assurance that our cybersecurity risk management program, security controls and security processes, or those of our third-party service providers will be fully implemented, complied with, or effective or that security breaches or disruptions will not materially impact our business. For example, scanning tools deployed in our IT environment allows us to identify and track certain known security vulnerabilities, but we cannot guarantee that patches or mitigating measures will be applied before vulnerabilities can be exploited by a threat actor.

We have experienced cybersecurity incidents that to date have not resulted in, and are not expected to result in, a material impact on the Company’s business operations or financial results. For example, we are regularly subject to phishing attempts, certain of our third-party service providers have experienced incidents, and in February 2023, the Company experienced a criminal ransomware attack affecting data contained on legacy servers of Weingarten Realty Investors (“WRI”), which the Company acquired in August 2021. Although none of these incidents materially impacted the Company, we cannot guarantee that material incidents will not occur in the future. Moreover, we have acquired in the past and may acquire in the future companies with cybersecurity vulnerabilities or unsophisticated security measures, which could expose us to significant cybersecurity, operational, and financial risks.

A cyber incident could materially affect our operations and financial condition by:

In addition, federal and state governments and agencies have enacted, and continue to develop, broad data protection legislation, regulations, and guidance that require companies to increasingly implement, monitor and enforce reasonable cybersecurity measures.

15

These governmental entities and agencies are aggressively investigating and enforcing such legislation, regulations and guidance across industry sectors and companies. We may be required to expend significant capital and other resources to address an attack or incident and our insurance may not cover some or all of our losses resulting from an attack or incident. These losses may include payments for investigations, forensic analyses, legal advice, public relations advice, system repair or replacement, or other services, in addition to any remedies or relief that may result from legal proceedings. The incurrence of these losses, costs or business interruptions may adversely affect our reputation as well as our financial condition, results of operations and cash flows.

Artificial intelligence presents risks and challenges that can impact our business, including by posing security risks to our confidential information, proprietary information, and personal data.

Issues in the development and use of artificial intelligence, combined with an uncertain regulatory environment, may result in reputational harm, liability, or other adverse consequences to our business operations. As with many technological innovations, artificial intelligence presents risks and challenges that could impact our business. We have adopted generative artificial intelligence tools into our systems for specific use cases, subject to the artificial intelligence use policies that have been established by our legal and information security teams, and we are continuing to evaluate additional uses for generative artificial intelligence. Moreover, artificial intelligence or machine learning models may create incomplete, inaccurate, or otherwise flawed outputs, some of which may appear correct. Due to these issues, these models could lead us to make flawed decisions that could result in adverse consequences to us, including exposure to reputational and competitive harm, customer loss, and legal liability. Our vendors or other third-party partners may incorporate generative artificial intelligence tools into their services and deliverables without disclosing this use to us, and the providers of these generative artificial intelligence tools may not meet existing or rapidly evolving regulatory or industry standards with respect to privacy and data protection and may inhibit our or our vendors’ ability to maintain an adequate level of service and experience. If we, our vendors, or our third-party partners experience an actual or perceived breach or a privacy or security incident because of the use of generative artificial intelligence, we may lose valuable intellectual property and confidential information, and our reputation and the public perception of the effectiveness of our security measures could be harmed. Additionally, the incorporation of artificial intelligence by our clients, vendors, contractors and other third parties into their products or services, with or without our knowledge, could give rise to issues pertaining to ethical, data privacy, information security and intellectual property considerations.

Further, bad actors around the world use increasingly sophisticated methods, including the use of artificial intelligence, to engage in illegal activities involving the theft and misuse of personal information, confidential information, and intellectual property. In addition, uncertainty in the legal regulatory regime relating to artificial intelligence may require significant resources to modify and maintain business practices to comply with applicable law, the nature of which cannot be determined at this time. Legal and regulatory obligations related to artificial intelligence may prevent or limit our ability to use artificial intelligence in our business, lead to regulatory fines or penalties, require implementation of costly compliance measures, or require us to change our business practices. If we cannot use artificial intelligence, or that use is restricted, our business may be less efficient, or we may be at a competitive disadvantage. Any of these outcomes could damage our reputation, result in the loss of valuable property and information, and adversely impact our business.

We may be subject to liability under environmental laws, ordinances and regulations.